Arizona Medicare Supplement insurance plans, also known as Medigap, are private insurance policies designed to help cover the cost-sharing requirements of Original Medicare (Parts A and B). Here are the key points about Medigap plans in Arizona:

- Coverage Gap Filling: Medigap policies fill in the “gaps” left by Original Medicare. These gaps include deductibles, copayments, and coinsurance.

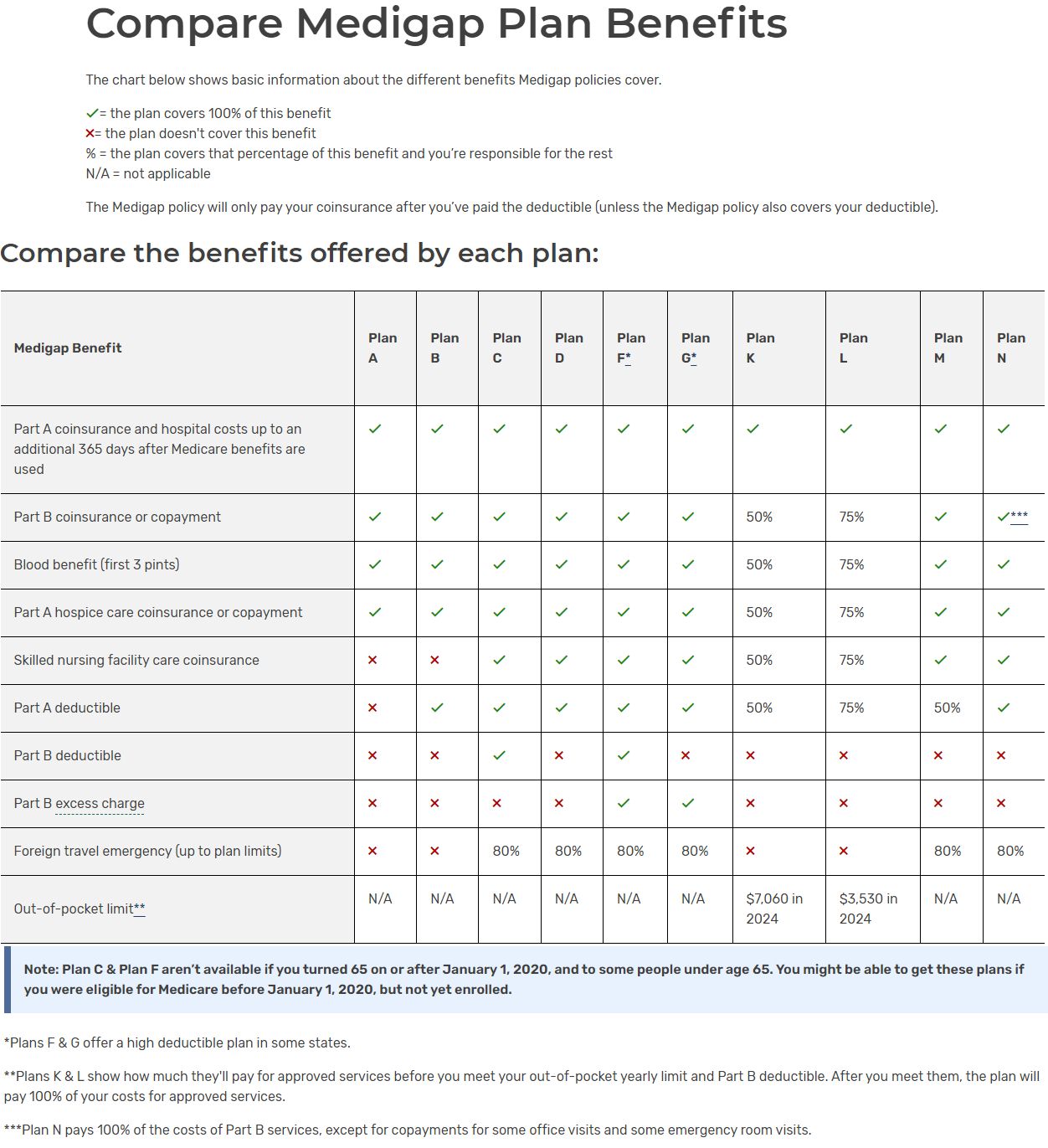

- Standardized Plans: There are ten standardized Medigap plans (A, B, C, D, F, G, K, L, M, and N) regulated by federal and state governments. Each plan offers different levels of coverage.

- Popular Plans in Arizona:

- Plan F: Although no longer available to new Medicare beneficiaries after December 31, 2019, it was a comprehensive plan covering most out-of-pocket costs.

- Plan G: Currently popular, it covers similar benefits to Plan F except for the Part B deductible.

- Other Plans: Arizona offers a range of other plans, each with varying levels of coverage.

- Costs and Availability:

- Monthly premiums depend on factors like age, gender, and the insurer.

- For a 65-year-old female non-tobacco user, Plan G premiums range from $97 to $471 per month.

- Note that Medigap insurers in Arizona are not required to offer plans to disabled Medicare beneficiaries under age 65. Comparison and Choice:

- Compare ratings and benefits of different Medigap providers in Arizona.

- Consider your health needs, budget, and preferences when choosing a plan.

Keep in Mind . . .

- Medicare does not cover all health care bills.

- Medicare has deductibles and cost sharing for some services

- Medicare Supplements have guaranteed issue periods, such as, when you first turn 65 or go on Medicare Part B. Guaranteed issue periods also include; if you lose your existing coverage due to moving, lose group coverage, or if your supplement company leaves your service area. At other times, you will be asked health questions when enrolling.

- The availability of Medicare supplements will differ among companies. In Arizona, numerous companies provide these supplements, and the crucial aspect is to choose a company that aligns with your needs and is a company that you are comfortable with.

- You must have Original Medicare (Parts A and B) to buy one.

- They have a monthly premium that you pay to the insurance company.

- You must also continue to pay your Medicare Part B premium.

- They don’t include prescription drug coverage — you must purchase a Part D plan separately.

- They generally don’t cover things like long-term care, vision, dental, hearing or private-duty nursing.

- They only cover one person — if you and your spouse want Medigap coverage, you’ll each need separate policies.

- Remember to consult a licensed insurance agent to explore your options and find the best Medigap plan for your specific situation

In summary, Medicare Advantage provides an all-in-one solution with additional benefits, while Medicare Supplement fills the gaps in Original Medicare coverage. The right choice depends on your individual health needs and preference.

To learn more about specific situation contact Ralph at 602-390-8573.